When it comes to securing your financial future and safeguarding your most valuable assets, understanding mortgages and insurance is crucial. These two pillars of financial planning can seem complex, but breaking them down can make them more approachable. This article will explore the basics of mortgages and insurance, offering insights to help you make informed decisions.

Understanding Mortgages

A mortgage is a loan specifically used to purchase real estate. It is secured by the property itself, meaning if the borrower fails to make payments, the lender can seize the property. Here are the key elements of a mortgage:

- Principal and Interest: The principal is the amount borrowed, while interest is the cost of borrowing that money. Mortgages typically come with either a fixed or variable interest rate.

- Down Payment: This is an upfront payment made when purchasing a property. It usually ranges from 5% to 20% of the property’s value, though lower down payments are available with certain types of loans.

- Term: The term is the length of time you have to repay the mortgage, commonly 15, 20, or 30 years. Shorter terms usually come with higher monthly payments but lower total interest costs.

- Amortization: This is the process of paying off the loan over time through regular payments. Each payment goes towards both the principal and the interest.

Types of Mortgages

- Fixed-Rate Mortgages: These have a constant interest rate and monthly payments that never change. They offer stability and predictability, making them a popular choice.

- Adjustable-Rate Mortgages (ARMs): These have interest rates that can change periodically, often starting lower than fixed rates but potentially increasing over time.

- Government-Backed Mortgages: These include FHA loans, VA loans, and USDA loans, each with specific eligibility requirements and benefits, such as lower down payments or no down payments.

Understanding Insurance

Insurance is a contract in which an individual or entity receives financial protection against losses from an insurance company. There are various types of insurance, each serving different purposes:

- Homeowners Insurance: This protects your home and belongings against damages and theft. It also provides liability coverage against accidents in the home or on the property.

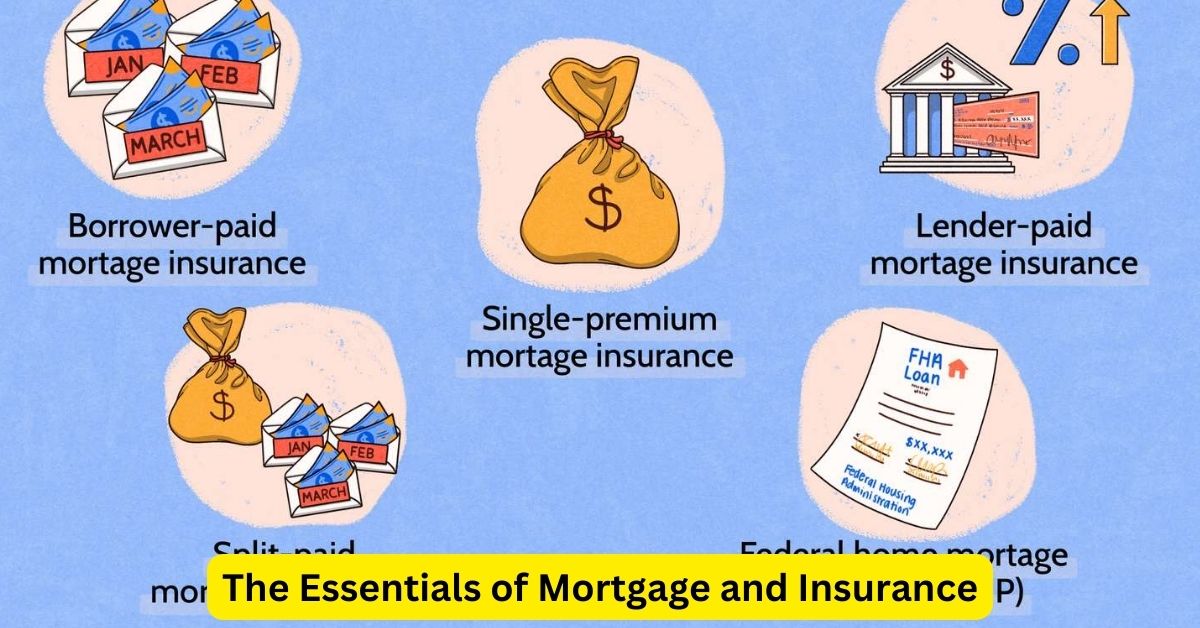

- Mortgage Insurance: Required for borrowers who make a down payment of less than 20%, mortgage insurance protects the lender in case of default.

- Life Insurance: This provides financial support to beneficiaries upon the policyholder’s death. It’s essential for anyone with dependents or significant financial obligations.

- Health Insurance: This covers medical expenses, ensuring that you can afford necessary healthcare without financial strain.

Choosing the Right Insurance

When selecting insurance policies, consider the following:

- Coverage Needs: Assess what you need to protect and choose a policy that offers adequate coverage.

- Policy Costs: Compare premiums, deductibles, and coverage limits to find a balance that fits your budget.

- Provider Reputation: Research insurance companies’ financial stability and customer service reputation.

Conclusion

Understanding mortgages and insurance is vital for making sound financial decisions. By familiarizing yourself with the basics and carefully evaluating your options, you can secure a mortgage that fits your needs and obtain insurance that protects your assets and loved ones. Take the time to consult with financial advisors or mortgage brokers, and don’t hesitate to ask questions to ensure you’re making the best choices for your financial future.