Achieving financial success requires a strategic balance between growing your investments and ensuring they are protected. Secure equity pros specialize in providing the expertise needed to navigate this balance, helping clients to build wealth through equity investments while implementing safeguards to protect their financial future. This article explores the key roles and strategies employed by secure equity professionals.

Understanding the Role of Secure Equity Professionals

Secure equity professionals focus on helping clients grow their wealth through equity markets, including stocks, mutual funds, and exchange-traded funds (ETFs). Their role extends beyond just identifying investment opportunities; they also emphasize risk management to protect clients’ financial interests.

- Crafting Personalized Investment Strategies

Secure equity pros work closely with clients to develop customized investment strategies. This involves assessing the client’s financial goals, risk tolerance, and time horizon. By understanding these factors, they can recommend a diversified portfolio that balances potential returns with acceptable levels of risk.

- In-Depth Market Analysis

Market analysis is a critical component of equity investment. Secure equity professionals leverage their expertise to analyze market trends, economic indicators, and company financials. This thorough analysis helps them identify high-potential investment opportunities and avoid potential pitfalls, ensuring clients’ portfolios are positioned for growth.

- Active Portfolio Management

Active management of investment portfolios is essential for optimizing returns and managing risks. Secure equity professionals continuously monitor market conditions and make necessary adjustments to clients’ portfolios. This proactive approach helps to capitalize on new opportunities and mitigate losses, ensuring that the investment strategy remains aligned with clients’ goals.

Implementing Financial Security Measures

While growing investments is important, protecting these investments from potential risks is equally crucial. Secure equity professionals incorporate various financial security measures into their strategies to safeguard clients’ wealth.

- Risk Assessment and Management

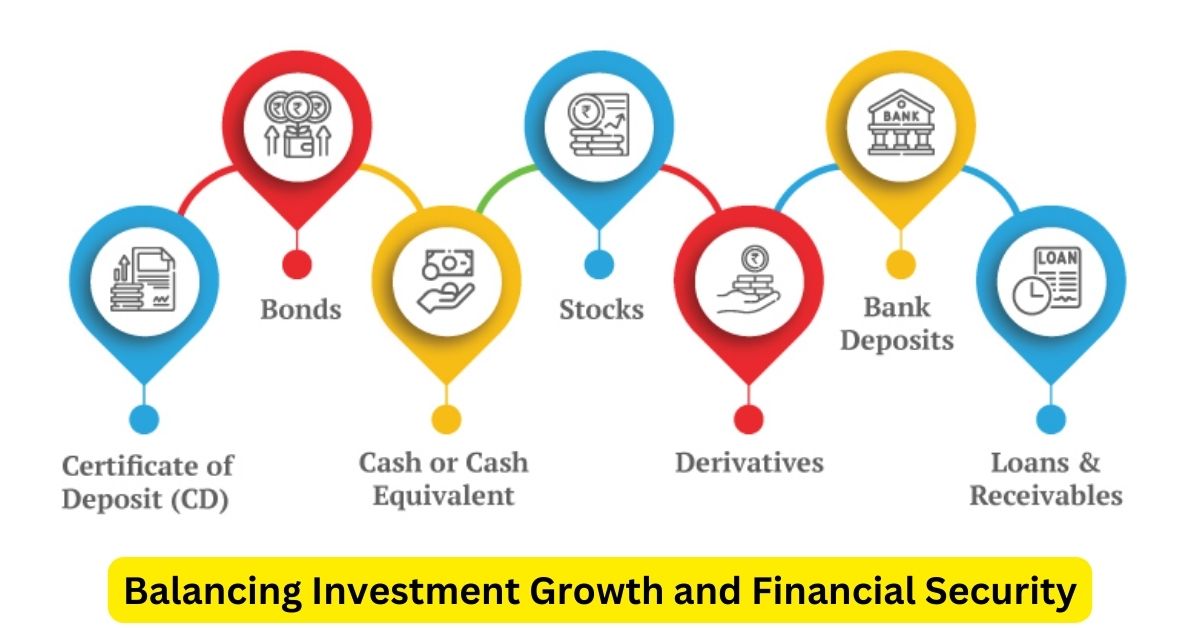

A comprehensive risk assessment is the first step in protecting investments. Secure equity pros evaluate potential risks, such as market volatility, economic downturns, and individual stock performance. Based on this assessment, they implement risk management strategies, such as asset allocation and diversification, to mitigate these risks.

- Insurance Solutions

Insurance plays a vital role in financial security. Secure equity professionals advise clients on appropriate insurance products, such as life insurance, disability insurance, and property insurance, to protect against unforeseen events. These insurance solutions provide a safety net, ensuring that clients’ financial plans are not derailed by unexpected occurrences.

- Emergency Funds and Contingency Planning

Establishing an emergency fund is a fundamental aspect of financial security. Secure equity pros recommend maintaining a fund with three to six months’ worth of living expenses to cover unexpected costs. Additionally, they help clients develop contingency plans to address potential financial disruptions, ensuring preparedness for any scenario.

The Integrated Approach to Financial Success

Combining growth and protection strategies results in a comprehensive approach to financial success. Secure equity professionals utilize their expertise in both investment and risk management to provide clients with a balanced and secure financial plan.

- Diversified Investment Portfolios

A well-diversified portfolio spreads risk across various asset classes and sectors, reducing the impact of any single investment’s poor performance. Secure equity pros ensure that clients’ portfolios are diversified to optimize returns while minimizing risks.

- Regular Financial Reviews

Regular reviews and adjustments of investment and protection strategies are essential. Secure equity professionals periodically reassess clients’ financial situations and goals, making necessary adjustments to ensure continued alignment with their objectives.

- Holistic Financial Planning

Secure equity professionals take a holistic approach to financial planning, considering all aspects of clients’ financial lives, including investments, insurance, estate planning, and tax strategies. This comprehensive perspective ensures that all elements work together to support long-term financial success and security.

Conclusion

Secure equity professionals play a crucial role in balancing investment growth and financial security. By crafting personalized investment strategies, conducting in-depth market analysis, and implementing robust risk management measures, they help clients achieve financial success while protecting their wealth. This integrated approach ensures that clients can confidently navigate the complexities of financial planning, enjoying both growth and security on their journey to financial prosperity.