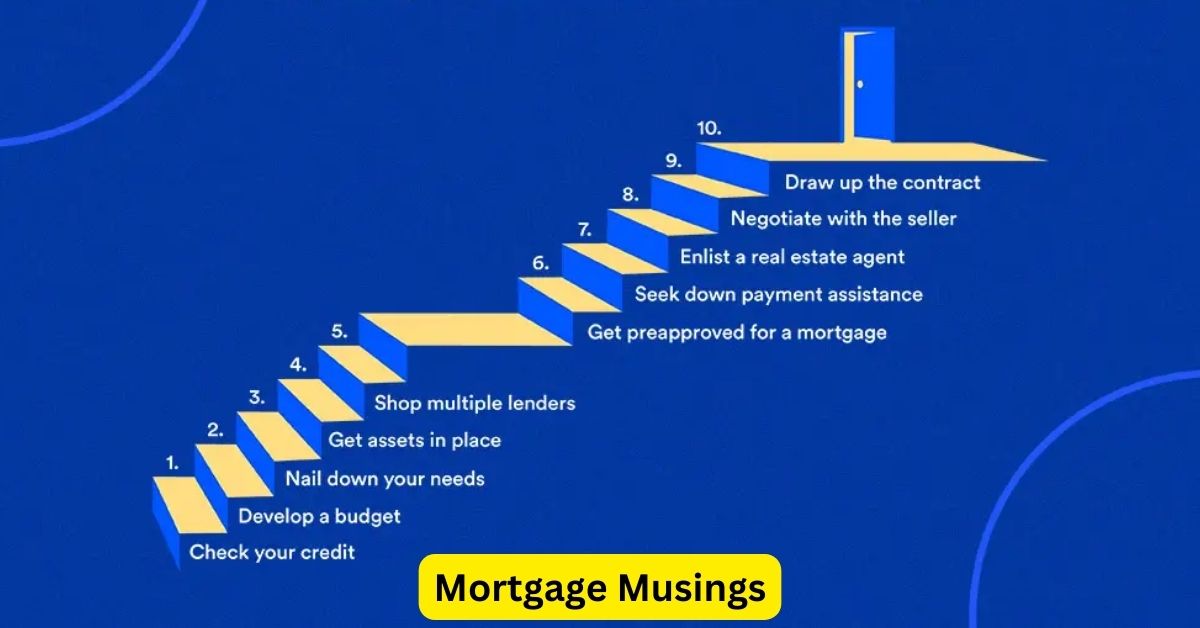

Owning a home is a significant milestone that requires careful financial planning and mortgage management. Here are essential tips and tricks to help navigate the journey of homeownership:

1. Assess Your Financial Readiness: Before diving into homeownership, evaluate your financial situation. Calculate your income, savings, and debts to determine how much you can afford to borrow. Use online mortgage calculators to estimate monthly payments and ensure they align with your budget.

2. Understand Mortgage Options: Familiarize yourself with different types of mortgages. Fixed-rate mortgages offer stable payments throughout the loan term, providing predictability. Adjustable-rate mortgages (ARMs) may start with lower initial rates but can fluctuate later. Choose a mortgage type that suits your financial goals and risk tolerance.

3. Check Your Credit Score: A good credit score is crucial for securing favorable mortgage terms. Obtain a free credit report and review it for any errors. Improve your credit score by paying down debts and avoiding new credit inquiries before applying for a mortgage.

4. Save for a Down Payment: Saving for a down payment is essential. While some loans offer options with low down payments, such as FHA loans requiring as little as 3.5%, a larger down payment (typically 20% or more) can eliminate the need for Private Mortgage Insurance (PMI) and lower overall borrowing costs.

5. Get Pre-Approved: Gain a competitive edge by getting pre-approved for a mortgage. This involves a lender reviewing your financial information and issuing a conditional commitment for a loan amount. Pre-approval signals to sellers that you are a serious buyer and simplifies the final approval process.

6. Compare Mortgage Offers: Shop around and compare mortgage offers from different lenders. Consider factors like interest rates, fees, closing costs, and customer service reputation. Online tools and mortgage brokers can assist in comparing offers and finding the best deal.

7. Budget for Additional Costs: Beyond the mortgage payment, budget for closing costs, which typically range from 2% to 5% of the home’s purchase price. These costs include fees for appraisals, inspections, title insurance, and legal services. Factor these expenses into your budget to avoid financial surprises at closing.

8. Understand Mortgage Terms: Thoroughly review and understand the mortgage terms before signing. Pay attention to interest rates, loan duration (e.g., 15 or 30 years), prepayment penalties, and options for refinancing. Clarity on these terms ensures informed decision-making and helps avoid unexpected financial obligations.

9. Plan for Homeownership Expenses: Prepare for ongoing homeownership expenses beyond the mortgage, such as property taxes, insurance, maintenance, and potential repairs. Setting aside funds for these expenses ensures financial stability and preserves your investment in the long run.

10. Seek Professional Guidance: Consult with a real estate agent and mortgage broker who specialize in homeownership. They provide valuable guidance on navigating the home buying and mortgage process, negotiating terms, and ensuring compliance with legal requirements.

By applying these tips and tricks, prospective homeowners can approach the mortgage process with confidence and set themselves up for successful homeownership. Careful financial planning, understanding mortgage options, and seeking professional advice are crucial steps toward achieving the dream of owning a home.