Insurance is more than just a financial product; it is a vital risk management tool that provides individuals and businesses with the ability to mitigate potential losses and protect against unforeseen events. By transferring risk from the insured to the insurer, insurance plays a crucial role in maintaining financial stability and security. This article explores the concept of insurance as a risk management tool, its significance, and how it can be effectively utilized to safeguard your financial future.

Understanding Risk Management

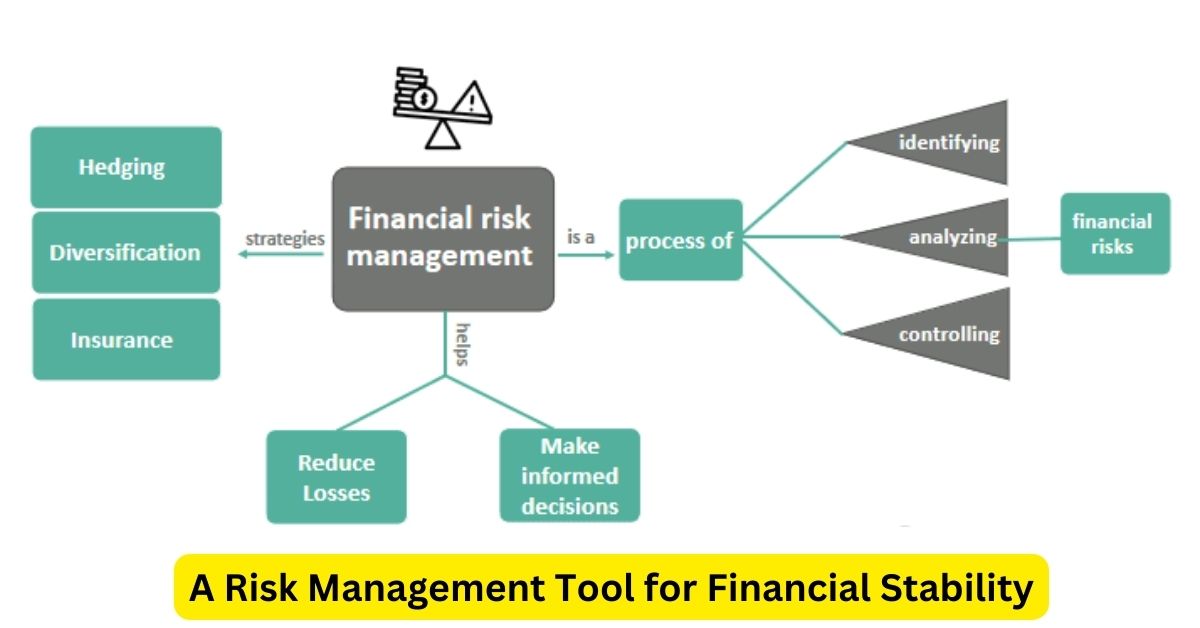

Risk management involves identifying, assessing, and prioritizing risks, followed by the application of strategies to minimize or control the impact of those risks. Insurance serves as a key component of this process by offering a structured way to manage risks that could otherwise lead to financial devastation. Whether it’s protecting assets, health, or income, insurance allows individuals and businesses to focus on their goals without the constant worry of potential setbacks.

The Role of Insurance in Risk Management

- Financial Protection: Insurance provides a financial safety net by covering losses resulting from unexpected events such as accidents, illnesses, natural disasters, or liability claims. By compensating for these losses, insurance helps prevent financial strain and ensures continuity in personal and professional lives.

- Peace of Mind: Knowing that you have insurance coverage in place offers peace of mind, allowing you to focus on your day-to-day activities and long-term goals without being preoccupied with potential risks. This assurance enables individuals and businesses to operate confidently and make informed decisions.

- Legal and Regulatory Compliance: In many cases, insurance is not just a choice but a legal requirement. For instance, auto insurance is mandatory in most regions to ensure that drivers can cover the costs of accidents they may cause. Similarly, businesses are often required to have liability insurance to protect against potential lawsuits. Compliance with these regulations helps avoid legal penalties and ensures that you meet societal standards of responsibility.

- Asset Protection: Insurance protects valuable assets such as homes, vehicles, and businesses from unexpected damage or loss. Homeowners insurance, for example, covers damage caused by events like fire or theft, while auto insurance provides coverage for car accidents and related damages. This protection helps maintain the value and functionality of your assets, preserving your financial stability.

- Income Continuity: Products like disability insurance and life insurance ensure income continuity in the face of life-altering events. Disability insurance provides income replacement if you cannot work due to an injury or illness, while life insurance ensures your family’s financial needs are met if you pass away unexpectedly. This continuity is crucial for maintaining your standard of living and meeting financial obligations.

Effective Use of Insurance as a Risk Management Tool

To use insurance effectively as a risk management tool, consider the following steps:

- Assess Your Risks: Identify potential risks that could impact your financial stability. This includes health issues, property damage, liability claims, and income loss.

- Determine Coverage Needs: Evaluate the type and level of coverage required to mitigate these risks effectively. Consider factors such as your financial situation, lifestyle, and long-term goals.

- Compare Insurance Policies: Shop around and compare different insurance providers and policies to find the best coverage at a competitive price. Look for policies that offer comprehensive coverage and align with your risk management needs.

- Review and Update Regularly: Regularly review and update your insurance policies to ensure they remain relevant and adequate as your circumstances change. Life events such as marriage, buying a home, or starting a business may necessitate adjustments to your coverage.

Conclusion

Insurance is an indispensable risk management tool that provides financial protection, peace of mind, and asset security. By effectively integrating insurance into your risk management strategy, you can safeguard your financial future and protect yourself from the uncertainties of life. Whether for personal or business purposes, understanding the role of insurance in risk management empowers you to make informed decisions and secure a stable financial foundation.