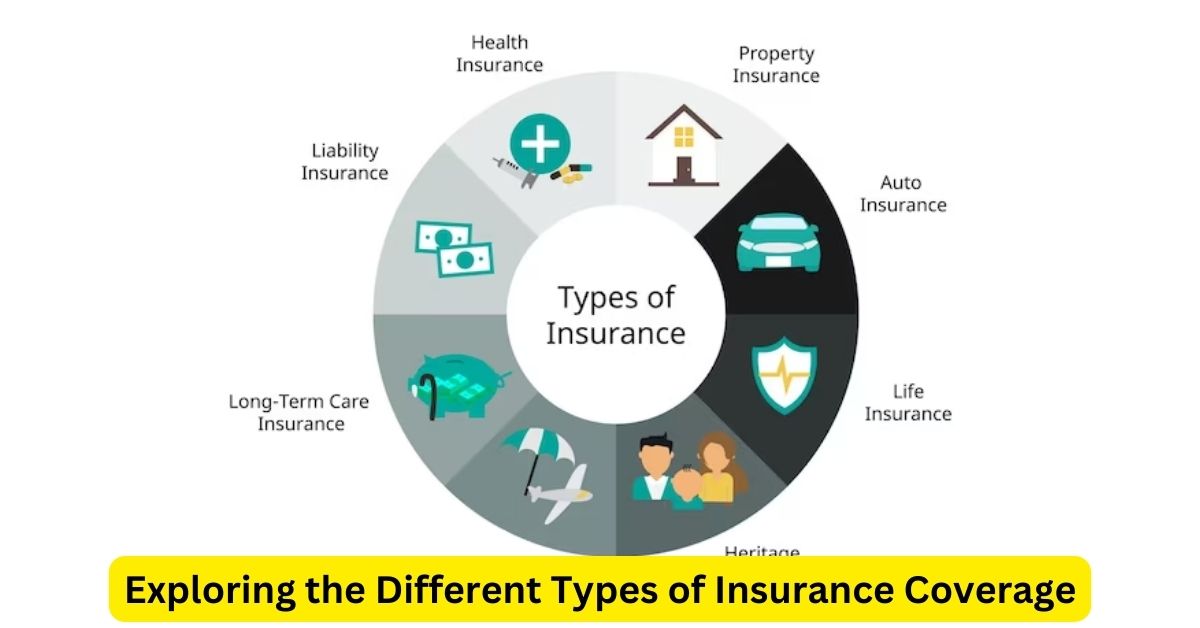

Insurance coverage is an essential part of financial planning, providing a safety net against unexpected events that can lead to significant financial strain. With various types of insurance available, it’s crucial to understand the options to ensure adequate protection for yourself, your family, and your assets. This article explores the different types of insurance coverage, highlighting their importance and key features.

1. Health Insurance

Health insurance is one of the most common forms of insurance coverage. It is designed to cover medical expenses arising from illnesses, injuries, and preventive care. Health insurance policies typically cover doctor visits, hospital stays, prescription medications, and various treatments. With rising healthcare costs, having health insurance is crucial to avoid overwhelming medical bills and to ensure access to necessary medical services.

2. Life Insurance

Life insurance provides financial support to beneficiaries upon the policyholder’s death. It is an essential part of long-term financial planning, offering peace of mind that loved ones will be financially secure in the event of the policyholder’s passing. Life insurance can cover expenses such as funeral costs, outstanding debts, and living expenses for surviving family members. There are two main types of life insurance: term life insurance, which covers a specific period, and whole life insurance, which provides lifelong coverage.

3. Auto Insurance

Auto insurance is mandatory in most regions for vehicle owners. It covers financial losses related to car accidents, theft, or damage to vehicles. Auto insurance policies often include liability coverage, which pays for damages or injuries you cause to others, as well as collision and comprehensive coverage, which protect your vehicle against accidents and non-accident-related damages like theft or natural disasters. Choosing the right auto insurance coverage ensures compliance with legal requirements and protects against costly repairs or medical expenses.

4. Homeowners Insurance

Homeowners insurance protects one of the most significant investments people make—their home. This insurance covers damage to the property due to events like fire, theft, vandalism, or natural disasters. Additionally, homeowners insurance typically includes liability coverage, which protects homeowners against accidents that may occur on their property. For those who rent, renter’s insurance provides similar coverage for personal belongings within a rented property.

5. Disability Insurance

Disability insurance provides income replacement if you cannot work due to a disability or injury. This coverage is particularly important for those whose livelihoods depend on their ability to work. Disability insurance ensures financial stability during periods when work is not possible due to illness or injury, helping to cover living expenses and maintain a standard of living.

6. Business Insurance

Business insurance covers various risks faced by companies, such as property damage, liability claims, and employee-related issues. This type of insurance is essential for protecting business assets and operations from unexpected disruptions. Business insurance can include general liability insurance, professional liability insurance, and property insurance, among others, tailored to meet specific industry needs.

Conclusion

In conclusion, understanding the different types of insurance coverage is crucial for making informed decisions about protecting yourself and your assets. From health and life insurance to auto, home, and business insurance, each type of coverage serves a unique purpose in safeguarding against potential risks. By choosing the appropriate insurance policies, you can ensure financial security and peace of mind in the face of life’s uncertainties.