In the realm of financial planning, achieving a balance between growth and protection is paramount. Equity and risk advisors specialize in guiding clients through this delicate balance, ensuring that their investments grow while safeguarding against potential risks. This article explores the roles and strategies employed by equity and risk advisors to help clients achieve financial stability.

Understanding the Role of Equity Advisors

Equity advisors focus on helping clients build wealth through investments in equity markets, including stocks, mutual funds, and exchange-traded funds (ETFs). Their expertise lies in identifying opportunities for capital appreciation and income generation while aligning investment strategies with clients’ financial goals and risk tolerance.

- Investment Strategy Development

Equity advisors work closely with clients to develop personalized investment strategies. This involves assessing the client’s financial situation, goals, and risk tolerance. Based on this assessment, advisors recommend a diversified portfolio that balances growth potential and risk.

- Market Analysis and Stock Selection

Equity advisors leverage their expertise in market analysis to identify promising investment opportunities. They conduct thorough research, analyzing financial statements, market trends, and economic indicators to select stocks and other equity investments that align with the client’s strategy.

- Portfolio Management

Active portfolio management is crucial for maximizing returns and managing risks. Equity advisors continuously monitor clients’ portfolios, making adjustments as needed to respond to market conditions, economic changes, and shifts in clients’ financial goals. This proactive approach helps optimize performance and mitigate potential losses.

The Role of Risk Advisors

Risk advisors, on the other hand, focus on protecting clients’ assets and financial well-being by identifying, assessing, and mitigating risks. Their expertise ensures that clients are prepared for unexpected events that could impact their financial stability.

- Risk Assessment

Risk advisors begin by conducting comprehensive risk assessments. This involves evaluating the client’s current financial situation, identifying potential risks, and analyzing the impact of these risks on their overall financial health. Common risks include market volatility, economic downturns, health emergencies, and legal liabilities.

- Insurance Solutions

One of the primary tools risk advisors use to mitigate risks is insurance. They help clients select appropriate insurance products, such as life insurance, health insurance, homeowners insurance, and liability insurance. Adequate insurance coverage protects against financial losses due to unforeseen events.

- Emergency Planning

Risk advisors emphasize the importance of emergency planning. This includes establishing an emergency fund to cover unexpected expenses and creating contingency plans for various scenarios. Emergency planning ensures that clients have a financial safety net in place, reducing the need to liquidate investments or incur debt during crises.

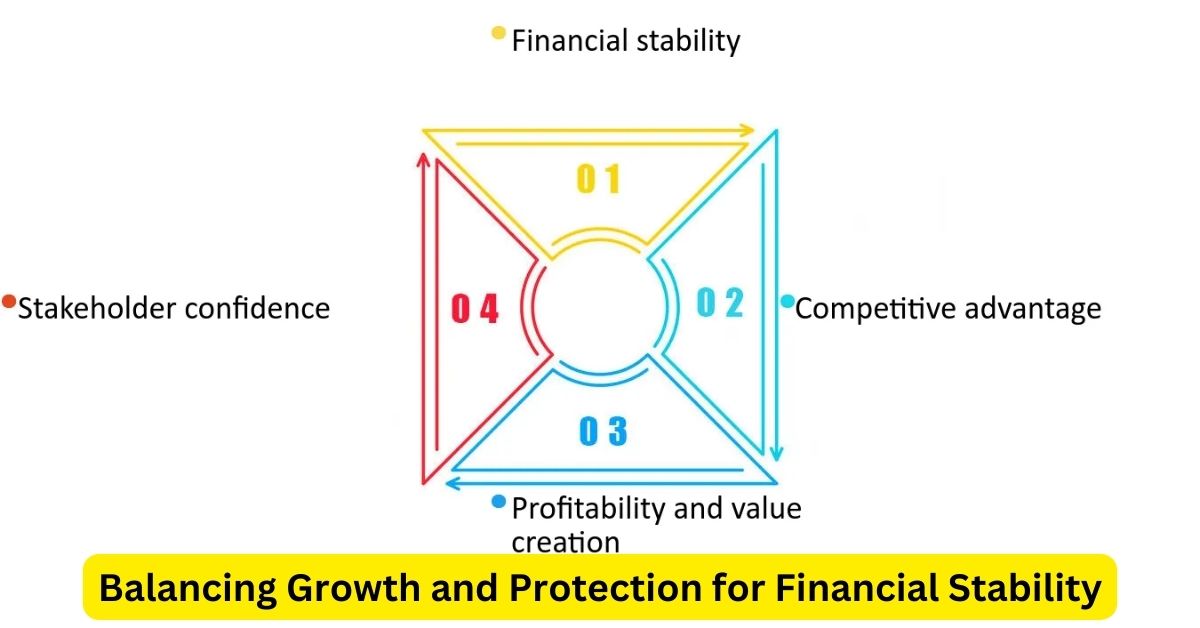

Integrated Approach for Financial Stability

Equity and risk advisors often work together to provide a comprehensive approach to financial planning. This integrated approach ensures that clients benefit from both growth opportunities and protective measures, creating a robust financial strategy.

- Diversified Investment Portfolios

Combining the expertise of equity and risk advisors leads to well-diversified investment portfolios. Diversification spreads risk across various asset classes and sectors, reducing the impact of any single investment’s poor performance on the overall portfolio.

- Regular Reviews and Adjustments

Regular reviews and adjustments are essential for maintaining the balance between growth and protection. Advisors periodically reassess clients’ financial situations, goals, and risk tolerance, making necessary adjustments to investment strategies and risk management plans.

- Holistic Financial Planning

A holistic approach to financial planning considers all aspects of a client’s financial life, including investments, insurance, estate planning, and tax strategies. This comprehensive perspective ensures that all elements work together to support long-term financial stability and growth.

Conclusion

Equity and risk advisors play a crucial role in helping clients navigate the complexities of financial planning. By focusing on both growth and protection, they ensure that clients can achieve financial stability and build wealth over time. Through personalized investment strategies, thorough risk assessments, and integrated planning, equity and risk advisors provide the guidance and support needed to balance growth opportunities with protective measures, securing a prosperous financial future.