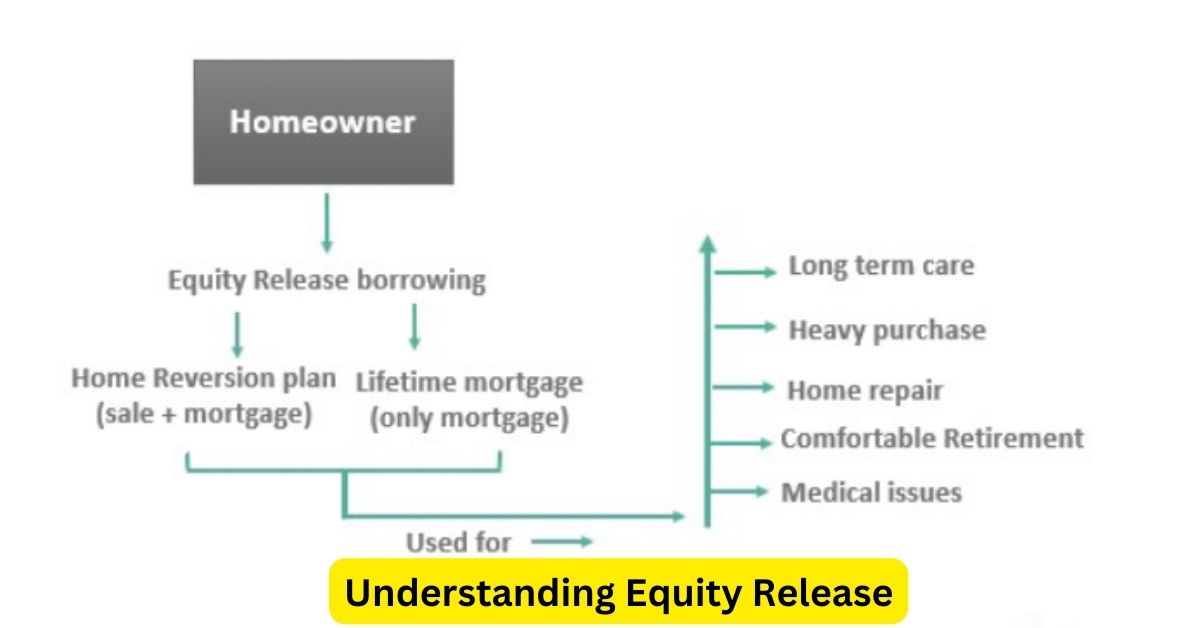

Equity release solutions have become increasingly popular among retirees looking to unlock the value tied up in their homes. These financial products offer a way to access the equity built in a property, providing additional income or a lump sum while allowing homeowners to continue living in their homes. Let’s delve into the concept of equity release and its benefits.

What is Equity Release?

Equity release refers to a range of products that allow homeowners, typically aged 55 and older, to access the equity (value) tied up in their property. Unlike traditional mortgages, equity release does not require monthly repayments. Instead, the loan, plus interest, is repaid when the property is sold, usually upon the homeowner’s death or when they move into long-term care.

Types of Equity Release

- Lifetime Mortgage: This is the most common form of equity release. It allows homeowners to borrow a lump sum or receive regular payments against the value of their home. Interest accrues on the loan, which is typically repaid from the sale of the property.

- Home Reversion Plan: With this option, homeowners sell part or all of their property to a provider in exchange for a lump sum or regular payments. They retain the right to live in the property rent-free until they pass away or move into care, at which point the property is sold, and the proceeds are divided based on the ownership percentage.

Benefits of Equity Release

- Supplement Retirement Income: For retirees with limited pension savings, equity release provides a way to supplement income without having to sell their home.

- Maintain Homeownership: Equity release allows homeowners to remain in their homes for life, providing security and continuity in familiar surroundings.

- Flexibility: Whether it’s funding home improvements, helping family members financially, or enjoying retirement more comfortably, equity release offers flexibility in how the funds can be used.

- No Negative Equity Guarantee: Most reputable equity release products come with a guarantee that the amount to be repaid will never exceed the value of the property, ensuring peace of mind for homeowners and their beneficiaries.

Considerations Before Choosing Equity Release

- Impact on Inheritance: Taking out equity release can reduce the value of inheritance you leave behind. It’s essential to discuss this with family members and consider their expectations.

- Financial Advice: Seek independent financial advice before committing to equity release. An advisor can help you understand the implications, alternatives, and ensure it’s the right decision for your financial situation.

- Legal Protection: Equity release products are regulated by the Financial Conduct Authority (FCA) to protect consumers. Ensure you understand the terms, fees, and legal implications before signing any agreements.

Conclusion

Equity release can provide a valuable financial lifeline for retirees seeking to enhance their quality of life without sacrificing homeownership. By understanding the types of equity release available, the benefits, and the considerations involved, homeowners can make informed decisions to secure their financial future effectively. It’s a flexible solution that offers peace of mind and financial security, allowing retirees to enjoy their later years with confidence.